More on Medicare 2025: Drug Costs

UPDATE – PLEASE SEE IN PURPLE AT THE BOTTOM

A couple of weeks back, we posted Medicare Health Insurance Choices that explained the differences and pitfalls between traditional Medicare Part A and B plus Medigap insurance plans to Part C, Medicare Advantage. Click the link earlier in the previous sentence if you missed it.

As many already know, there is a Part D that covers drug costs. It is either purchased as a separate plan or rolled into Part C Advantage. Drug coverage is significantly changing this year, and AnCan has learnt that many of our participants are not yet aware. Hardly surprising because CMS as well as the various stakeholders like Payers and providers have done very little to let us patients know. Why should they? – we’re only the ultimate consumer!

The same cannot be said of JnJ who started educating patient advocate organizations this past May. In October and November JnJ created more education that includes a webinar and a round table coming up hosted by NAMAPA, the National Association for Medication Access and Patient Advocacy. Likely you have never heard of them. I hadn’t and it hardly rolls off the tongue. Nonetheless, the webinar was very instructive and you can watch it here.

The BIG difference for us patients is that no matter what, out-of-pocket drug costs for 2025 cannot exceed $2000. You heard right – for those of you on specialty oral medications like Nubeqa (darolutamide for prostate cancer) or Aubagio (teriflunomide for MS), normally sourced via specialty pharmacies, you will meet this cap January. And you’ll even be able to spread the payment over 12 months! More on that to follow.

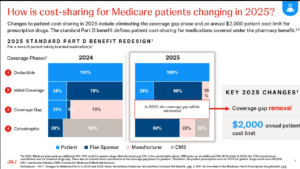

But first, how is this coming about. Well it tracks back tot he changes brought about by the Inflation Reduction Act signed by President Biden in 2022. He promised to make drugs more affordable,  and this is a part of the plan. As you can see in the slide to the left comparing 2024 to 2025, the donut hole has been eliminated. In its place, the Payer (Plan Sponsor) and Pharma (manufacturer) are paying more. While the cost saving is very positive, it will likely impact us patients in other ways:

and this is a part of the plan. As you can see in the slide to the left comparing 2024 to 2025, the donut hole has been eliminated. In its place, the Payer (Plan Sponsor) and Pharma (manufacturer) are paying more. While the cost saving is very positive, it will likely impact us patients in other ways:

- Your formulary choice may be reduced – so CHECK your medications before you renew.

- Premiums for Part D may increase – even though out of pocket is capped. If you are unlikely to spend $2,000, look for a plan that defers your co-pay as long as possible

- Higher premium plans should cover a larger portion of drug costs earlier. Your premium does NOT count towards the $2,000, so include premiums in your cost calculation to figure your exposure.

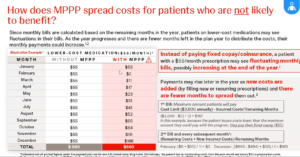

If you have a co-pay or co-insurance on your drugs, no matter if it’s Part C or D, it cannot exceed $2,000. However the amount you pay and who you pay it to may become a bit of a moving target. We mentioned earlier that you will now have the opportunity to spread your payments over the calendar year – or the remainder of it, if you sign up late or incur costs late in the year. The Medicare Prescription Payment Plan (M3P) takes your share of drug costs, up to a maximum of $2,000, and spreads them over the remainder of the year.

The simple example is for those on specialty pharmaceutical drugs like Nubeqa or Aubagio. Since your share of the drug cost is almost certainly going to be greater than $2,000 in January, if you opt in for M3P BEFORE going to the pharmacy or ordering from your mail order pharmacy, you’ll pay nothing on picking up/shipping the drugs. Subsequently, you’ll get a separate bill from your Payer for $167.67 monthly over 12 months, and pay no more for any of your drugs the rest of the year. There is NO interest, no late fee penalties, and you get a couple of months leeway, but there are penalties if you never pay. You can sign up for MP3 with your Medicare Payer/Plan Holder BUT not in the pharmacy for 2025. So if you arrive at the drug store prior to enrollment, you’ll be charged $2,000 to take your pills home. You can leave the pills, go home, enroll and return to the pharmacy 24 hours later and pick up without payment to the pharmacy..

If you don’t start this expensive drug until mid year, say September, and you’ve spent nothing on drugs prior, then the $2,000 is billed over the last 4 months at $500/month.

But what if your drug costs are more lumpy – they go up and down the whole year. In that case, the payments get recalculated each month and the monthly bill will vary.

But what if your drug costs are more lumpy – they go up and down the whole year. In that case, the payments get recalculated each month and the monthly bill will vary.

There is a strange case too, if you know your co-pay is the same each month – say $55. This really throws M3P, and as you can see to the left, you’ll pay the same $660 (12x $55) either way but in different amounts each month if enrolled in M3P.

Finally, let’s address the Drug Benefit plans that many of you enjoy through PAN, PAF and others. Even the drug discount cards from Pharma that some receive. Whatever you receive, or however you receive it, does NOT reduce your $2,000 exposure. You advise the pharmacy that you have a benefit, and they bill the Benefit Provider (PAN, PAF, Pharma ??). The credit will be applied against your drug cost, although eventually you may still be liable for up to $2,000 co-pay when the benefit runs out.

Looking at the first slide, it seems to AnCan that these benefits that are often funded by Pharma, eventually flow back to Pharma and the Payer. How they will credit them against what the patient owes is not yet clear. Before you get too crazed, our guess is the system has to change. These benefits need to be channeled directly to patients who cannot afford $2,000 p.a. AnCan is on it and already reaching out to NAMAPA and others to promote more of a direct, income based subsidy possibly reaching more beneficiaries. One thing we have heard – APPLY EARLY for 2025 in the event you are in line to receive a subsidy.

Attribution: UPDATE – Slides are now available at Understanding Medicare Part D Changes and Their Impact on Patient Out-Of-Pocket Costs in 2025 prepared by JnJ and presented by NAMAPA and JnJ.!!

PLEASE BE SURE TO SIGN UP FOR THE M3P PROGRAM UPFRONT. EVEN IF YOU OWE $2,000 IT WILL BE BILLED IN 12 INSTALLMENTS. WE STILLL HAVE TO FIGURE HOW YOU WILL BE REIMBURSED IF YOU RECEIVE ASSISTANCE.

IF YOU HAVE A GRANT BE SURE TO PROVIDE DETALS TO THE PHARMACY ASAP. NOTWITHSTANDING, ALSO REACH OUT TO YOUR GRANTOR TO FIND HOW THEY WANT TO COORDINATE THE GRANT. IT’S STILLL A MOVING TARGET!